Module One:

Digital Application

FirstClose Equity’s digital application is extremely flexible. You can invite your potential borrowers to a website branded as your own to complete the digital application or you can have your loan officers use it when they meet with clients directly. All applications follow the same, consistent workflow.

The borrower will be asked several non-invasive personal and property questions, configured by you. If the potential borrower meets your loan program requirements, they are asked to verify the information submitted, provide eConsent, and agree to a soft pull of their credit.

With credit pulled, and the borrower’s address verified, the borrower can immediately check their available equity and view their offer. Borrowers have full control of their finance options, and your terms are clearly provided for compliance. Once the borrower decides how they’d like to proceed, they simply advance through the application process.

- Gives consumers instant online feedback on their home valuation, available home equity & loan options.

- Delivers credit decisions within 5-to-7 minutes.

- Captures employment and HMDA data. TCPA disclosure acceptance is also tracked and logged for compliance purposes.

- Data feeds back to your decision engine, enabling the system to return an instant pre-approved offer to the borrower with an audit trail.

- Once the borrower accepts the offer, they can manage the rest of the transaction within their secure borrower portal.

Digital Loan Product Wizard

FirstClose recognizes that home equity lending is a powerful financial tool for households. To empower your members and highlight the advantages of using home equity for debt consolidation, we’ve developed the FirstClose Digital Loan Officer. This intuitive tool demonstrates potential savings from consolidating high-interest debt and is now available to integrate seamlessly with FirstClose Equity – the only digital application inquiry solution specifically designed for home equity lending.

Pilot program revealed a 10% increase in conversion rates when the Digital Loan Product Wizard was utilized compared to traditional methods.

Debt Consolidation Feature

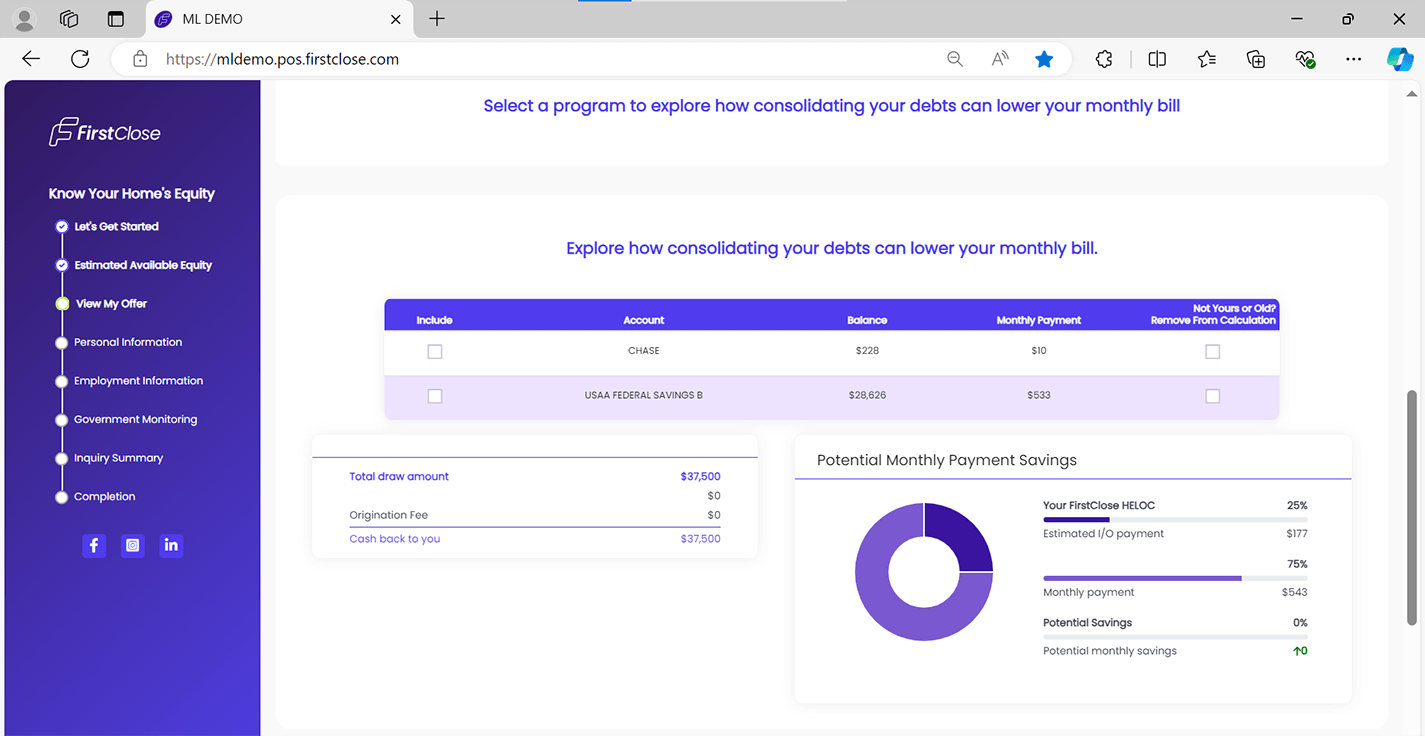

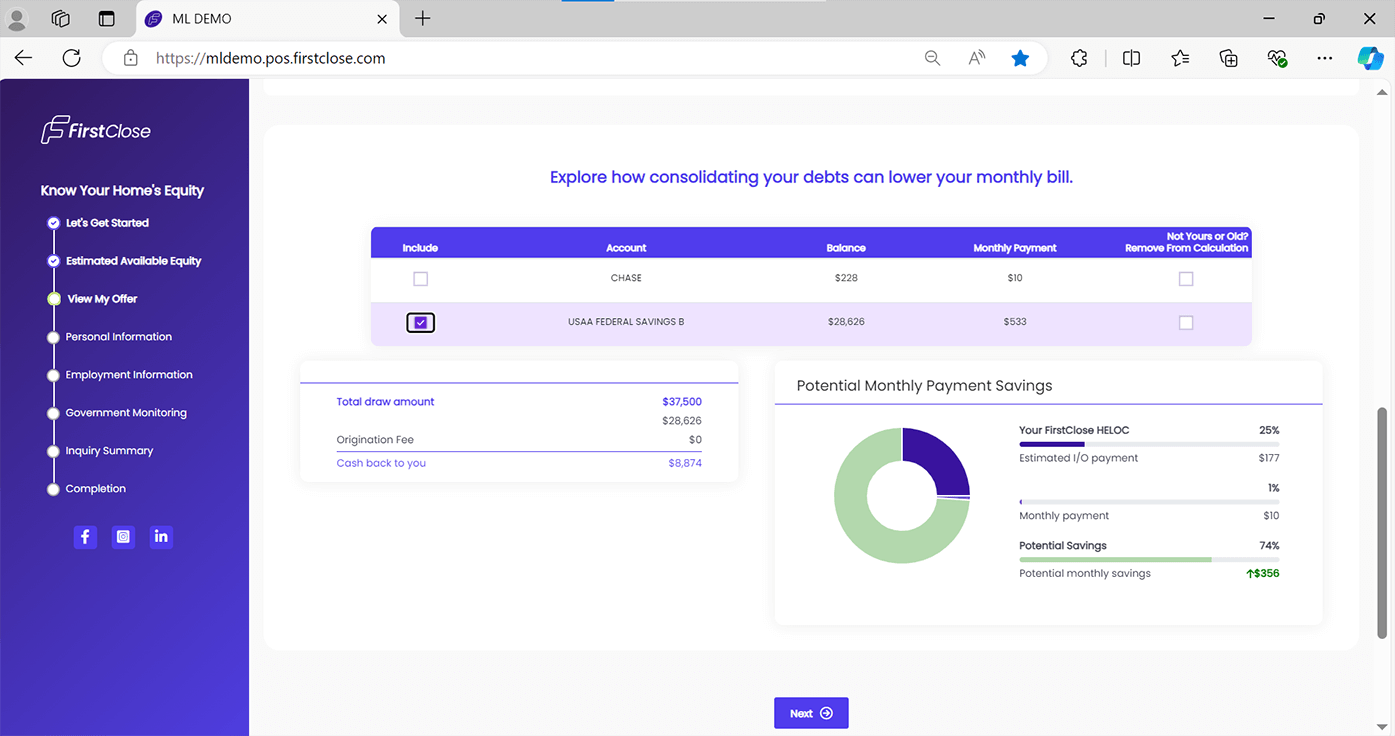

The debt consolidation feature on the view my offer page of the digital application allows borrowers to consolidate debts into pre-qualified home equity products with the focus on providing better conversion for lenders and a debt consolidation tool for borrowers. The system pulls the borrower’s existing tradeline data to grab the creditor’s name, the balance, and the monthly payment for each tradeline. This allows FirstClose Equity to build the Debt Consolidation table.

The borrower can choose which tradelines to include or exclude in their debt consolidation plan and debt consolidation savings calculator. If the included tradeline amount exceeds the line amount, then the system will display a message informing the borrower and recommend that they increase their line amount.

The “Line Amount Used” displays to the borrower the amount of the loan they intend to use to consolidate their debt. Moreover, it indicates the cashback they will receive after debt consolidation based on their draw or line amount if the draw amount isn’t supported.

By showcasing the value of your Home Equity offering early in the process, the Digital Loan Officer enhances borrower education and satisfaction, setting the stage for stronger engagement and increased loan conversions.